- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

The electronics supply chain has always been associated with complexity on a number of levels. From the increased amount of components in smartphones, to the surge of demand for electronics in vehicles, to dwindling product life cycles and demand for more consistent updates, the pressure to innovate is higher than ever.

Prior to 2020, all of this occurred in a tense global climate. The trade war and component shortages were at the top of everyone’s mind. Then, COVID-19 came and brought everything to a boiling point. In the midst of everything, we need direction and actionable insights more than ever. It all starts with having the right data, which we now have thanks to survey data from sourcing, supply chain, and procurement professionals.

Supplyframe + Dimensional Research: Identifying Relevant Opportunities

To better understand the impact of this on strategic sourcing of electronics commodities, new product introduction (NPI), and direct materials procurement as a whole, Supplyframe partnered with Dimensional Research to identify opportunities for improvement across the industry.

The survey consists of sourcing, procurement, and supply chain professionals who were all invited to complete an online questionnaire. Topics included sourcing, the state of collaboration in the organization, and challenges surrounding technology.

In total, there were 217 participants who worked at global manufacturing companies in the high tech, industrial equipment, automotive, medical device, and aerospace industries., with 500 or more employees. The analysis and interpretation of this data led us to identify four key concepts that should play a major role in forming current and future strategies in key areas of the business.

4 Key Concepts That Inform Current and Future Strategies

The purpose of the survey conducted by Dimensional Research was to address relevant challenges related to sourcing electronics commodities and collaboration with engineering teams. How does electronics sourcing effectiveness impact business performance? What capabilities and applications are supporting electronics sourcing and NPI efforts, and which ones are holding them back?

Most importantly, which improvements could yield the greatest results across various elements of the business? We now have the data to sufficiently answer those questions:

1 – Sourcing Issues are Directly Impacting Business Outcomes

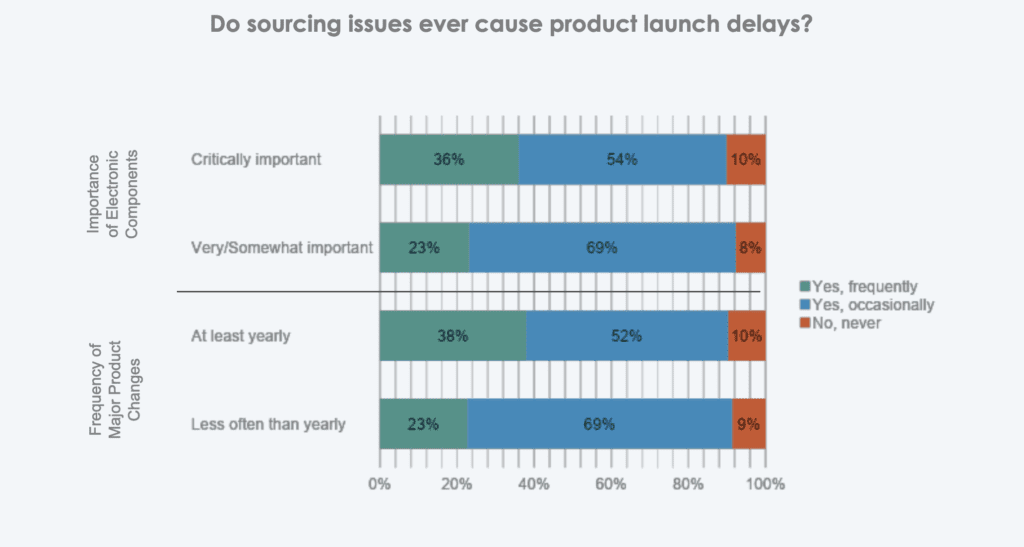

Problems in sourcing have existed long before the challenges that 2020 brought to the table, but the circumstances surrounding COVID-19 have exacerbated the already lingering obstacles. Based on data from the survey, we identified the following statistics:

- 91% say that sourcing issues have resulted in product delays

- 81% feel forced to make spot buys at a premium because of availability issues

- 93% report problems with compliance negatively impacting the sourcing process

Strategic sourcing of direct materials is both a critical and dynamic element of a global manufacturing leader’s performance. It represents the greatest opportunity for growth and optimization, but also one of the highest risk factors.

That’s why it is paramount to have multiple supply sources or alternate components in mind as part of a risk-balanced strategic sourcing strategy. A delay in critical parts lead times directly contributes to a delay in product launch.

In some cases, there’s an opportunity to quickly switch to other suppliers when shortages arise, but the vast majority of the multi-tier supply base is not ready or able to make agile shifts in this manner.

Instead, supply visibility and sourcing intelligence become the primary elements against continuity of supply challenges and allow sourcing and NPI teams to make critical trade-off decisions in the moment and prevent costly delays or spot buying.

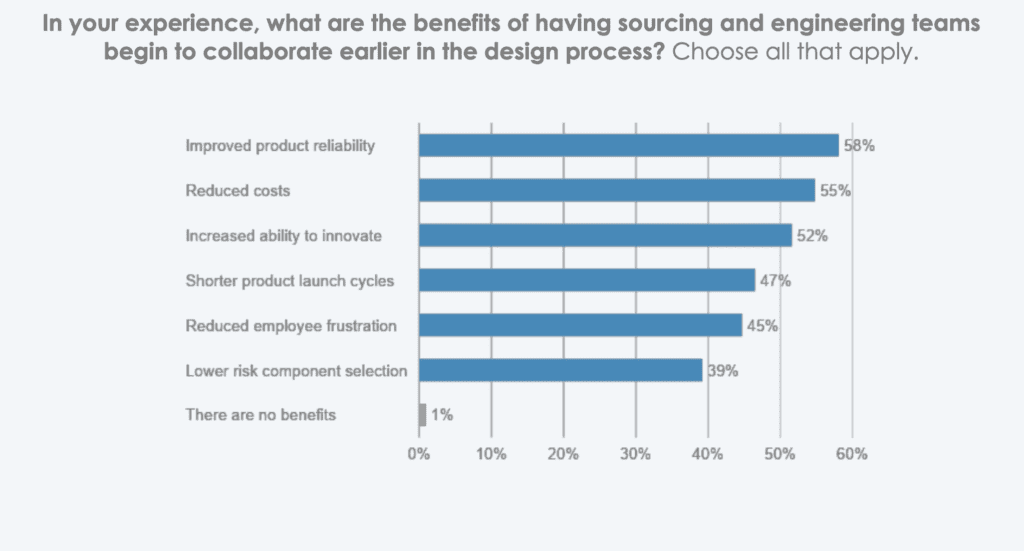

2 – Collaborating Early is Key to Success

Collaboration has long been a buzzword in global manufacturing, but it is one that’s too often stifled by rigid silos that prevent cross-team communication. Keeping this in mind, consider the following statistics from our survey:

- 99% report direct benefits from early collaboration between sourcing and engineering teams;

- 79% claim collaboration issues have caused product introduction delays

- 85% say that engineers select components that cannot be effectively sourced; and

- 95% agree that solving component sourcing challenges requires the integration of engineering, sourcing, and other partners

It’s not outside the realm of reason to say that individuals in sourcing, supply chain, finance, and engineering all speak different “languages.” They have their own priorities, key performance indicators (KPIs) and focus points, but this gap continues to contribute to broader overall impact on enterprise performance.

Each of these teams should be in constant communication and incorporate diverse insights and options to ensure proper collaboration and trade-off analysis.

By encouraging this kind of teamwork earlier in the design process, you remove roadblocks surrounding baked ideas that aren’t viable later on in the manufacturing process.

3 – Existing Sourcing Technologies are Archaic and Inefficient

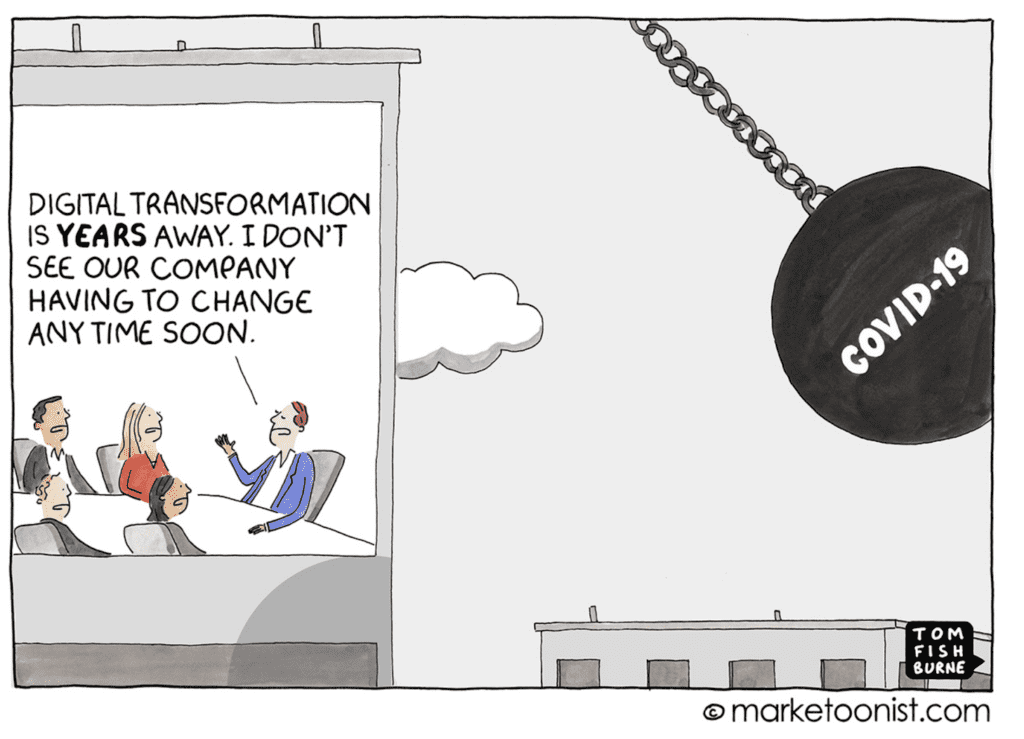

Another buzzword that often finds its way into conversation is “Digital Transformation.” It’s a concept that organizations have been slow to adopt. Part of this is due to a common change management challenge, but it’s also a result of individuals believing their process is “good enough.”

For many, 2020 has become the year where they discover that what they’re doing is no longer sustainable:

- 89% of survey participants experience obstacles in their existing applications for sourcing electronics components;

- 77% report that Enterprise Resource Planning (ERP) and Product Lifecycle Management (PLM) are not a good fit for their needs;

- 99% experience some sort of challenges as a result of their sourcing applications; and

- 81% note that their sourcing applications prevent them from finding optimal cost options

Applications and custom systems that support direct materials sourcing and NPI program management vary widely, but often boil down to the use of static spreadsheets and excessive email threads as their basis for tracking and collaboration.

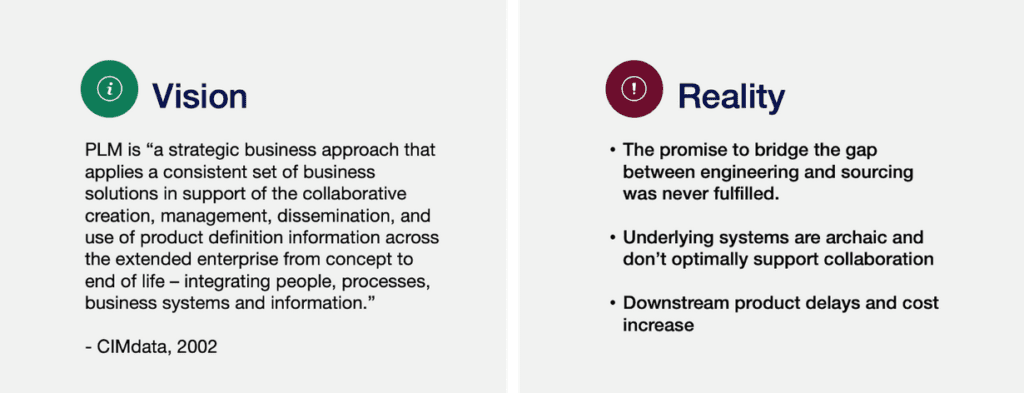

The original vision for Product Lifecycle Management (PLM), identified in 2002, was to enable collaborative decision making across multiple internal groups and external partners over the entire product lifecycle. Unfortunately that vision has not been realized.

Legacy systems and ad hoc tools are holding the strategic sourcing and NPI teams back as a whole. Not only does sourcing itself stand to gain from the proper software solutions, but the organization’s bottom line stands to gain both greater agility and improved product lifecycle margins as well.

4 – Improved Sourcing Technology Offers Substantial Value

Improved management of direct material spend in the design phase is one of the most opportune cost levers for your organization. If you make a significant change here, the positive effects are felt across the business.

In our latest whitepaper, we discussed the mandate for digital transformation in NPI processes, and the same mandate applies to all other applications of electronics component sourcing.

Our research also supports this, with a broad understanding of the potential benefits:

- 99% believe they would benefit from additional sourcing technology in the form of applications or capabilities; and

- 91% say their companies could grow faster with more effective sourcing technology

Given the results of our exploration with Dimensional Research, the business case is clear for the immediate digital transformation of NPI collaboration with strategic sourcing of electronics commodities across the majority of global manufacturers.

Explore the potential benefits of improved trade-off analysis and collaboration during NPI program review, or how leveraging new forms of sourcing intelligence improves time to market, product profitability, and market responsiveness.

The focus for how to thrive in the coming “next normal” is on removing silo-based decision making and focusing on adoption of supporting systems of intelligence to meet the challenges of our modern era.

You can download the full Dimensional Research Report here. For more information on Supplyframe’s solutions, visit our website, and share your own personal experiences with digital transformation in the comments!