- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

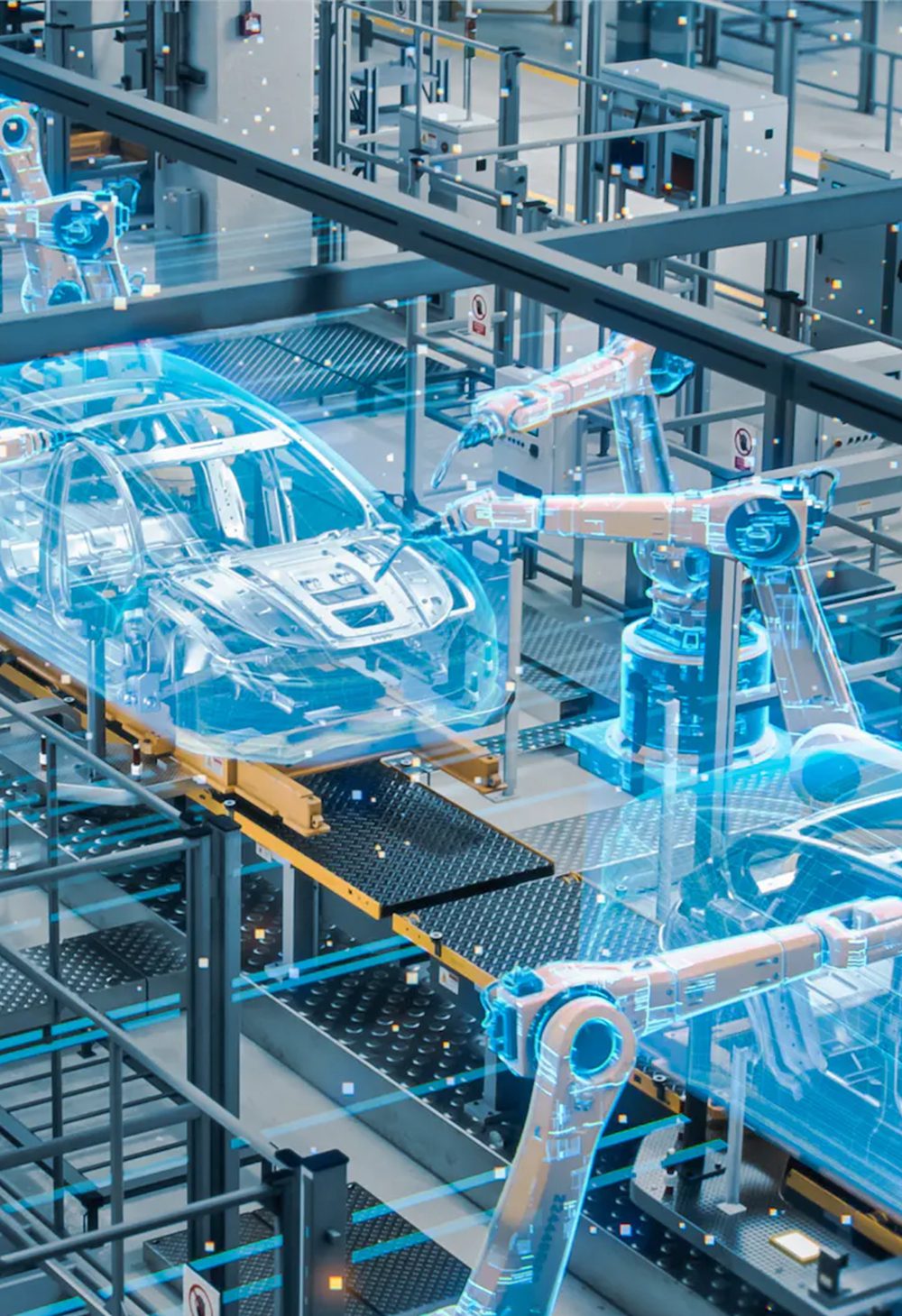

Automotive supply chains are being reshaped by the electric vehicle (EV), and soaring demand for chips made from silicon carbide (SiC). The race to secure sufficient supplies of SiC-based devices, including MOSFETs, has spurred major acquisitions, galvanized sweeping strategic agreements, and unleashed massive sales growth for suppliers positioned to fulfill the boom in sales.

For automakers and their suppliers, these developments serve as an urgent signal to prepare for the SiC transition by qualifying parts, undertaking required design changes and making essential supply-chain investments.

The Race For Silicon Carbide Chips

SiC is well suited for the rigors of EV powertrains, delivering higher levels of thermal conductivity, switching efficiency and electric current density than silicon-based alternatives like insulated gate bipolar transistors (IGBTs). SiC MOSFETs can support switching voltages of 1700V and higher, compared to about 600V for IGBTs.

SiC devices also sport up to 10 times more breakdown electric field strength than IGBTs.With Goldman Sachs projecting global EV sales will rise by a factor of more than 36 from 2020 to 2040, the current strong demand for SiC devices will be multiplied during the coming years.

The SiC transition is already boosting the bottom line of some chip suppliers. For example, Onsemi reported that its automotive business surged by 38% in the first quarter due to rising demand for its SiC MOSFETs.

The SiC shift also compelled leading automotive supplier Bosch to acquire U.S. chipmaker TSI Semiconductors and invest $1.5 billion to enable the production of SiC chips by 2026. In addition, STMicroelectronics (STM) signed a long-term agreement with ZF Group to supply over 10 million SiC devices by 2025.

Overcoming Challenges on The Road to EVs

However, SiC devices bring new challenges alongside their advantages in automotive supply chains. Migrating from IGBTs to SiC MOSFETs requires higher gate-to-source voltages, which in turn necessitates changes to design and part selection.

These modifications include the utilization of alternative packaging types and the adoption of new MOSFET gate driver devices. Buyers need to closely monitor the design cycle for EV powertrains to identify changes in part selection and qualify suitable parts and suppliers.

With many automakers striving to migrate their entire car lineups to EV technology, the SiC transition process will likely be complex and require years to complete.

Just as importantly, competition to source SiC parts is fierce and will only intensify in the future. Supplyframe’s Commodity IQ Power Transistor Demand Index is set to rise 22% from December 2022 through May 2023.

To stay ahead of developments in SiC components, and across numerous other electronics commodities, unlock real-time decision support with Commodity IQ.