- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

Welcome to the Commodities Analyzed series! In this series, we take a deeper look at data and analysis from Supplyframe Commodity IQ’s recent mid-quarter 2023 summary, offering a look at what users can expect and learn from the information available to them.

In this article, we look at capacitors, offering a combination of real-world data, deep expert analysis, and a better understanding of how key metrics like lead times, pricing, and availability will shift for this commodity in 2023.

Capacitor Overview and Market Outlook For 2023

Capacitors are one of the most important and fundamental components used in electrical circuits – capacitors are passive components that temporarily store electric current. Examples of non-ceramic capacitors include film capacitors, paper capacitors, and electrolytic and tantalum capacitors.

Non-ceramic capacitors are amongst the most employed electronic components, translating into many target markets, including:

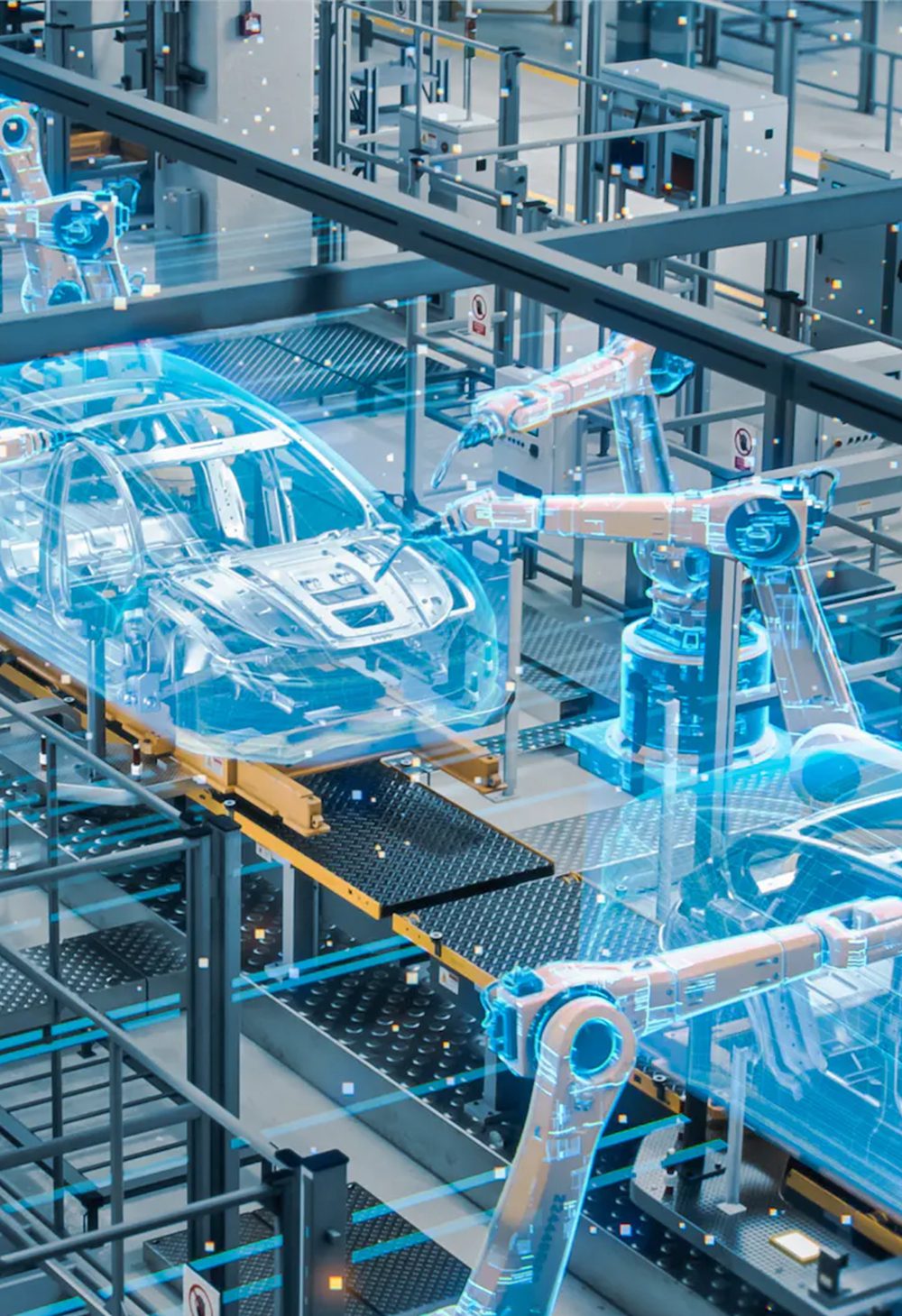

- Automotive

- Aerospace & Defense

- Telecommunications

- Consumer Electronics / Smartphones

The year 2022 was a challenging period for the capacitor market as sourcing activity slumped during every quarter. The cause? A significant global slowdown in demand for smartphones and other consumer devices that require a variety of capacitors.

This shift occurred as many central banks worldwide raised interest rates to curb inflation, resulting in slower GDP growth that threatened recessions in some countries. Another contributor was an inventory correction in the second half of 2022, primarily impacting small case-size capacitors. The result? A 22% decline in global capacitor sourcing activity in 2022, according to the Supplyframe Commodity IQ Demand Index.

The capacitor market slowdown continued into Q1 2023 with a 28% drop in demand activities compared to Q1 2022. What’s more, Commodity IQ data indicate that elevated prices and lead times will continue through most of 2023, impacting automotive markets around the world that rely on mature process nodes, including automotive.

According to industry sources, with reduced capacity utilization of multi-layer ceramic capacitors (MLCCs) – as low as 50% for some Taiwanese manufacturers – global shipments for 2023 are forecast to decline by 9% year-on-year, according to industry sources. MLCCs temporarily charge and discharge electricity which regulates the current flow in a circuit and prevents electromagnetic interference between components.

Still, the capacitor market is looking a bit brighter as prices trend lower and availability trends higher by 70% in Q1 2023 compared to Q4 2022. In H2 2023, the semiconductor supply is expected to improve, although the (MLCC) supply will tighten.

Automotive capacitor demand is expected to be positive throughout 2023 as vehicle electrification ramps up. The market is expanding as automakers design high-end infotainment systems, vehicle frames, and powertrain components. MLCC market leaders Murata, Samsung, YAGEO, and Taiyo Yuden are adding capacity to keep pace with growing demand, primarily for the electric vehicle (EV) in the automotive market and 5G service upgrades in the telecommunications sector. The strong demand by these two sectors for hybrid capacitors is likely to cause supply constraints which will prolong allocation.

Capacitor Insights From Commodity IQ

Volume capacitor buyers are seeing backlog reductions, with manufacturers averaging 2 to 3 months of back orders. In the automotive market, large case-size ceramic capacitor backlogs are over 3 or 4 months. Over the next decade, global capacitor demand is forecast to grow by about 6% annually, according to Supplyframe Commodity IQ.

Electronic component lead times are improving faster than prices as demand slows down in some markets. Also, inventories are at historical highs, and new disruptions could emerge with further intensifying geopolitical tensions between China and the US. Moreover, the COVID-19 pandemic is lingering, which could impact consumer demand and contribute to volatility, particularly in China.

In January 2023, demand dropped by 27% compared to January 2022. Yet, despite lower demand, price reductions are still hard to find in 2Q 2023. The culprits are raw material inflation and labor constraints in some electronic commodity sectors that are stalling price reductions. And yet, price reductions are still hard to achieve despite lower demand. Stubborn raw material inflation and labor constraints in some commodities, including electronic components, are stalling price reductions, while others are experiencing early pricing improvements.

Our Point of View and Forecast For Capacitors

Still, the future of the global capacitor market over the next few years looks promising, with opportunities in the automotive, computer, consumer electronics, industrial, and telecom sectors. As a result, the global capacitor market is forecast to reach $31.2 billion by 2027, with a CAGR of 5.9% from 2021 to 2027, according to Lucintel. The major drivers for this market are increasing demand for consumer electronics products, growing demand for premium smartphones, and increasing production of electric vehicles.

A year ago, in May 2022, Supplyframe Commodity IQ Predictive Intelligence spotted a sharp downturn in demand for consumer electronics, PCs, and smartphones by analyzing the engineering design actions, demand sourcing signals, and contract pricing for specific electronics components widely employed in these sectors; for example, DDR4 DRAM in the PC market. This demand across passive and active commodities decreased by 27% in Q1 2022 and 18% in Q4 2022.

The Key Takeaway? Focus on The Ultra-Small

Surprisingly, price reductions have been hard to achieve despite the lower demand. The reason is raw material inflation and labor constraints in some commodity sectors. One emerging trend impacting the capacitor market is the development of ultra-small case-size capacitors for portable electronic devices. Specifically, mass markets for surface mount (SMT) components, emphasizing MLCC capacitors, molded tantalum chip capacitors, polymer aluminum chip and SMD film chip capacitors, thick film chip resistors, ferrite beads and ceramic chip inductors.

The research team explored the consumption of these mass-produced passive electronic components by end-use market and world region. It focused on the value and volume of demand for each type of component and the changes in technology that enabled component manufacturers to achieve ultra-small volumetric efficiency using ceramics, metals, and plastics.

The study also evaluated the ability of MLCCs to continually produce smaller case-size chips with increasingly larger capacitance. Competing technologies, such as tantalum, polymer aluminum and PPS, PEN and PET film, are attempting to match capacitance or compete in markets on the finished product’s performance or voltage handling capability.

In addition, the study compared the competitive nature of capacitors by case size and documented consumption based on breakthroughs in the volumetric efficiency of components based on changes in raw materials. It also addressed the differences in components, such as capacitors, linear resistors, discrete inductors, and non-linear resistors and products that lag behind other components and which components and case sizes are growing in demand.

Finally, the competitive nature of each sub-category in the passive component market is determined by the market shares in MLCC, thick film chip resistors, tantalum capacitors, SMD plastic film chips and organic polymer aluminum capacitors.

To stay ahead of emerging trends and shifts across the commodities you care about, learn more about Supplyframe Commodity IQ today.