- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

In May of 2024, President Biden’s Administration directed the office of the US Trade Representative (USTR) to increase tariffs on $18 billion worth of Chinese imports, specifically semiconductors, solar cells, and lithium-ion batteries, after an extensive review of existing tariffs under Section 301 of the Trade Act of 1974.

These new China tariffs will hit the electric vehicle industry hard, with an estimated quadrupling of the rate from 25% to 100%. The US National Economic Council said the actions would create a level playing field in industries that are vital for the future of US manufacturing.

An Ongoing Shift in United States Trade Policy

The new tariffs target growth industries as well as national security sectors. They mark a shift in US trade policy targeting growth industries and the national security sector with consequences for global business.

The White House said the tariffs result from China’s trade practices concerning technology, transfer, intellectual property, and innovation.

The announcement came shortly after US Treasury Secretary Janet Yellen and US Secretary of State Antony Blinken expressed concerns about China’s manufacturing overcapacity during their recent visit.

Biden’s tariff increase builds on Donald Trump’s sweeping $300 billion program in 2018 and 2019, which levied heavy tariffs against China and other trading partners.

The tariffs further demonstrate a shift in US trade policy, with far-reaching consequences for global business. Moreover, they come during an election year in which both candidates have fully embraced protectionism, albeit with significant differences.

In the post-war era, US trade policy was focused primarily on opening markets, with US presidents generally opposing Congress’s more localized interests. That era is over.

Economic growth, inflation, and the Fed

If approved, the latest US tariffs will be rolled out over the next two years. The US economy is projected to maintain robust growth and strong consumer spending despite a forecast of high interest rates.

The net economic effect of import tariffs, retaliatory tariffs, and agricultural subsidies “was at best a wash, and it may have been mildly negative to US jobs and businesses,” according to the National Bureau of Economic Research working paper published in January 2024.

According to the NBER working paper, the trade war appeared to have political benefits, strengthening support for the Republican party in the US heartland and communities most affected by the tariffs.

They wrote that residents of tariff-protected locations became less likely to identify as Democrats and more likely to vote for Republican candidates. “Voters thus appear to have responded favorably to the extension of tariff protections to local industries despite their economic cost.”

Manufacturing in Mexico is on The Rise

The US and China are both buying their way into Mexico. However, by the end of 2023, imports from China were down 3% relative to 2019, while imports from South Korea, Singapore, Taiwan, and Vietnam increased by 50%, according to Nicole Cervi, an economist at Wells Fargo, in a CNN interview.

“There’s some data to suggest that we’ve seen stronger imports from countries outside of China, and some of it may be that Chinese businesses are perhaps relocating some of their operations to these other countries unaffected by the Section 301 tariffs,” Cervi said.

Recent ocean and air freight data further raise suspicions that China may be trying to circumvent US tariffs via Mexico, said Peter Sand, chief analyst with Xeneta, an ocean and air freight analytics and logistics company.

Container shipping imports from China to Mexico rocketed higher by 60% in January and 34% for the first quarter, Xeneta data shows. According to Sand, what was once an immature trade lane is now one of the busiest in the world.

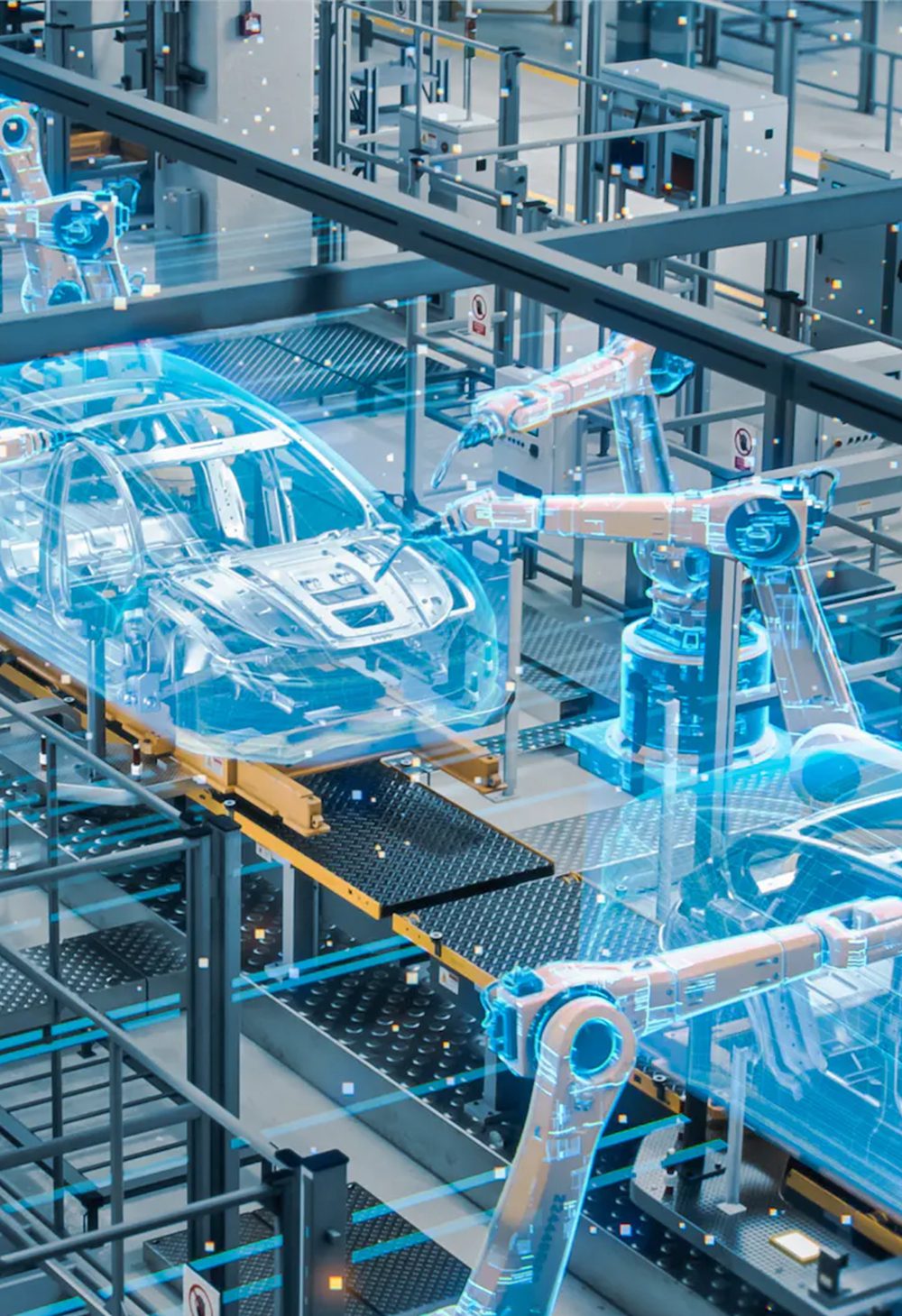

How New Tariffs Could Reignite Automotive Supply-chain Struggles

According to the US Semiconductor Industry Association, China’s share of semiconductor production for 28nm and larger is set to rise to 37% by 2032. During the last five years, Chinese companies have invested over $63 billion into 73 fabs, focusing on these older processes.

These trailing-edge processes are extensively used in producing automotive chips, ranging from discretes to logic devices like MCUs. The slowdown in EV and overall sales growth has led to normalized supply and pricing conditions after the shortages of recent years.

However, these new China tariffs could put pricing pressure on automotive semiconductor buyers. Pricing is already rising, and lead times are extending for power MOSFETS. The Commodity IQ Price Index is set to reach 327.13 in May, far above the baseline.

These conditions are likely to worsen due to the new tariff adjustments. Buyers should seek out alternate sources of supply for automotive chips and braces for higher procurement expenses, particularly for MOSFETS.

Supplyframe Commodity IQ helps industry professionals stay ahead of the latest trends and forecasts affecting commodity pricing and lead times. Elevate your intelligence today.