- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

The events of 2020 continue to ripple throughout the global electronics value chain. While companies are rushing to accelerate digital transformation initiatives, many are falling behind in the transformation of digital customer engagement and revenue acceleration. Just as the global electronics value chain has shifted its approach to risk and resiliency, so too have customers changed how they interact and purchase from global suppliers and distributors.

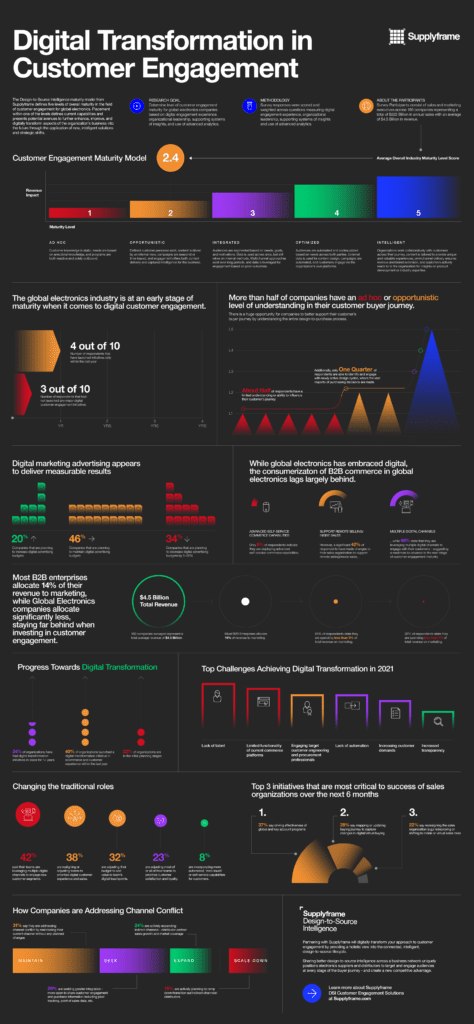

A Supplyframe survey of sales and marketing leaders across 180 leading semiconductor manufacturers, global component suppliers, and distributors representing close to a trillion in annual revenue revealed low levels of maturity in regards to their digital customer engagement strategies. The study explored multiple dimensions of readiness including digital engagement experience, organizational leadership, supporting systems of insights and use of advanced analytics. We have captured the main takeaways from these findings in an infographic below:

Here are the main takeaways from the survey’s results that reveal opportunities for a new approach:

The Industry’s Approach to Customer Engagement as a Whole is Behind The Curve

Within the last year, over 40% of organizations in the survey launched some sort of digital transformation initiative. Despite this, 36% did not launch any digital customer engagement programs to address this aspect of the business.

The industry as a whole is still in an early stage of maturity in this regard. Among the other respondents, 41% reported that they have launched some sort of customer engagement initiative, but even these are within the last year. As a result, shifting customer expectations are moving much faster than the pace of innovation across the buyer’s journey.

Companies Can Support and Influence The Buyer’s Journey With The Right Intelligence

A lack of visibility into the “buyer’s journey” of their manufacturing customers, from product design through manufacturing and strategic sourcing, leaves many suppliers and distributors without the context they need to provide meaningful input and influence during key points in the overall design cycle.

Almost half of the survey respondents (44% to be exact), claimed to have a limited understanding or ability to influence the customer’s decision-making during their purchase journey. As part of this issue, only 23% reported the ability to identify and engage with emerging design cycles across their current and target markets for growth. This crucial element of the process is where a vast majority of the purchasing decisions are made.

Customer Data Management Presents Another Valuable Opportunity

The survey data here shows that 56% of respondents have a relatively immature model for customer data management, with insights that are difficult to access and segmentation techniques that don’t offer enough granularity for meaningful decision-making.

We found that 18% of organizations point to issues with siloed data that’s difficult to integrate. Furthermore 38% tend to segment their customer data based on purchase patterns and demographics. An extremely small amount of respondents are utilizing modern marketing technology that leverages automation or real-time analytics, with 10% and 8% reporting these capabilities respectively.

Digital Marketing Advertising Techniques Produce Results

Approximately 46% of organizations in the survey plan to maintain or increase their digital advertising budgets. The latter group comprises 20% of total respondents, while only 34% report plans to decrease their budgets.

With customers making the majority of their purchasing decisions before ever reaching your website or platform, it’s imperative that you connect to them where they are with targeted and relevant advertising.

As Global Electronics Embraces Digital Transformation, B2B Commerce Lags Behind

In response to demand shifts, new purchase patterns, and global lockdowns, 42% of respondents made changes to their sales organizations that focus on remote selling or insider sales. As expected, 48% also state they are leveraging multiple digital channels to engage with customers.

Despite all of this, a shockingly low 8% of respondents indicated that they are deploying some form of self-service commerce capabilities.

Compared to Traditional B2B Enterprises, Global Electronics Organizations Have Significantly Smaller Marketing Budgets

Of the responses, 85% reported spending less than 3% of total revenue on marketing, while 32% allocate less than 1%.

The average for the B2B industry is 11.3% of total revenue, according to a 2020 survey of CMOs in the industry. The disparity here represents a potential obstacle facing organizations that seek to embrace and transform their customer’s buyer journey.

A Final Takeaway: The Time for Transformation is Now

The global electronics industry must adjust and transform its approach to customer engagement to meet the shifting demands and expectations of their customers.

Supplyframe’s solutions provide a foundation for a redefined customer journey, offering solutions across syndicated technical content, design assets, targeted advertising, and configure, price, quote. Learn more about our solutions for suppliers and distributors today!