- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

Welcome to part two of our series on the trends that defined 2022. If you missed part one, click here to catch up on the first 5 trends. In this second half, we will dive deeper into five more events from the past year, discussing their implications for 2023 and beyond.

Join us as we explore the year that was, and how it will shape the events of the coming twelve months.

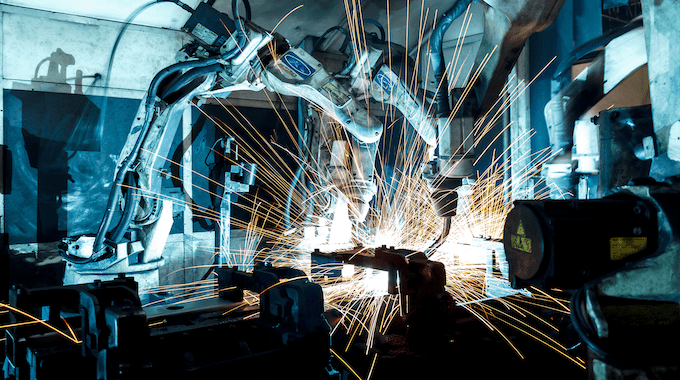

6) Making the Transition From ICE to EV

Perhaps the most important question for EV automakers and their supply chains is to ensure battery makers have a steady supply of raw materials to keep production going. The main ingredients include lithium, graphite, cobalt, manganese and nickel. The International Energy Agency (IEA) has projected that demand for lithium could grow a staggering 40 times by 2040 if the world adopts and adheres to the current net-zero pledges for sustainable development. Demand is already at an all-time high, and a significant increase in lithium mining will be necessary to meet the demand for EV batteries in the next few years.

Another raw materials challenge for automakers is that China processes about 70% of the world’s lithium and cobalt, which could be problematic for the US and Europe as geopolitical tension with China increases. To avoid a shortage of raw metals, European and US automakers, including BMW, General Motors, Tesla and Volkswagen, are buying raw materials directly from the mines instead of from the battery processing companies.

One strategy for automakers to ensure a stable, sustainable raw materials supply is to recycle used batteries to reclaim the minerals. Today’s lithium-ion battery recycling methods, such as hydrometallurgy and pyrometallurgy, are effective but only recover specific metals, primarily cobalt and nickel, although some recyclers are able to recover lithium. There’s a lot of research required to make recycling EV batteries more economical and productive. This will become more important in the decades ahead as the demand for battery raw materials grows.

The primary electric and electronic systems in EVs include the control unit that manages the drivetrain and the driver’s cockpit control module that manages AD software applications such as safety systems like lane departure and passenger entertainment units. Some of today’s EVs include more than 150 electronic control units with accompanying software. 5G infrastructure delivers AD services to EVs, but coverage is not universal. The initial launch of 6G in late 2023 will significantly expand the capability and transmission speed. However, 6G for consumers is expected to be available around 2030.

Vehicle ADAS, such as pedestrian detection, adaptive cruise control, collision avoidance, lane correction and automated parking, are now commonplace. However, they require the driver to be in the driver’s seat. Over time, the driver’s role will be unnecessary as autonomous features become more sophisticated.

Advanced communications, such as next-generation high-speed 6G technology, is essential in the move toward higher levels of autonomy. According to a 2021 research report by Canalys, approximately 33% of new vehicles sold in the United States, Europe, Japan, and China had ADAS features. In addition, the firm predicted that 50% of all automobiles on the road by 2030 would be ADAS-enabled.

7) India is Getting into The Chip-Making Business

Today, India produces zero semiconductors. However, it has plenty of skilled engineers who design semiconductors. Eight of the largest semiconductor firms in the world have design houses in India that take advantage of India’s native semiconductor intellectual property (IP). Now, the Indian government is trying to woo chipmakers to build an ecosystem to produce chips in-country that includes IP owned by Indian companies.

A case in point is ISMC Digital, a consortium of investors that is planning to build a $3 billion chip manufacturing facility in India. Tower Semiconductor, an Israeli company, would be the technology partner on the project.

However, the ISMC Digital plant will make older-generation, trailing-edge semiconductors rather than the cutting-edge components made by TSMC and others. These trailing-edge chips are still vital, specifically for the auto market. While a good place to start, focusing on the trailing edge would constrain India’s potential to become a global hub for the latest chips that are competitive with leading chipmakers in Taiwan, Korea, Japan, and the US, especially as competition rises between countries.

Many countries, including the US, are wooing leading-edge node foundries with much larger incentive packages than India is offering. Consequently, India may have to temper its expectations in the short term.

Meanwhile, Foxconn, the Taiwanese contract manufacturer that assembles Apple’s iPhones, and Indian mining company Vedanta have teamed up to build a $19.5 billion chip-making facility in the Indian state of Gujarat, the home of Prime Minister Narendra Modi, for its semiconductor project. Vedanta has obtained financial and non-financial subsidies on capital expenditure and cheap electricity.

These investments are among the first round of semiconductor manufacturing plants in India. Other chip companies with operations in India include MediaTek, NXP Semiconductors, and TSMC. While Intel does not manufacture in India, it is committed to building an India-based chip ecosystem. Intel employs around 14,000 in India and has invested over $8 billion in India.

India is targeting these and other major chip companies to invest more in India in the coming years.

Three Semiconductor Manufacturing Investments Announced for India

- Foxconn, the Taiwanese firm that assembles Apple iPhones, and Vedanta, an Indian mining company, have teamed up to build a $20 billion chip factory in Prime Minister Narendra Modi’s home state of Gujarat.

- Israeli chip companies Tower Semiconductor and ISMC Digital are investing $3 billion to build a manufacture semiconductors in the Indian state of Karnataka. The facility will produce 65nm analog chips.

- A Singapore-based consortium led by IGSS Ventures is planning to build a plant proposal to the government for setting up a special purpose vehicle with three equity partners to build a $3.5 billion chip plant in the Indian state of Tamil Nadu within the next two years with the capacity to produce 40,000 wafers a month.

8) Do We Need to Worry About Covid-19 in 2023?

For nearly three years, the Covid-19 pandemic has roiled industries worldwide, including the global semiconductor sector. Countless supply chains across the manufacturing sector broke down because electronic components worth pennies were unavailable.

A case in point is the global auto industry, which was hit hard in 2020 as assembly lines were shut down. Before the Covid-19 pandemic hit, the US auto industry had five years of annual sales of 17 million cars. In August 2022, the average new vehicle sold for $48,301, 10.8% higher than a year ago. In December, Cox Automotive projected that Americans may have bought as few as 13.3 million vehicles. Projections of US car sales for 2023 were expected to increase. However, it is looking likely there will be new production cuts.

In October, another wave of COVID-19 infections emerged in Europe as cases began to tick up across the continent, according to the World Health Organization and European Centre for Disease Prevention and Control. “Although we are not where we were one year ago, it is clear that the COVID-19 pandemic is still not over,” the two organizations said in a joint statement.

A month later, the Biden Administration declared the continuation of the US Covid-19 public health emergency through the Spring of 2023. The Department of Health and Human Services had previously extended the emergency until January, but officials expect another COVID surge this winter, hence the extension.

Perhaps most surprising is China’s abrupt Covid-19 course change announced in early December. It was a sharp shift away from its zero-tolerance policy, China’s playbook for eliminating the virus since early 2020. The rapid reversal has reportedly caused an eruption of new cases in China. Hospitals in Beijing are overwhelmed. After lifting control restrictions, China has set up a nationwide network of hospitals to monitor mutations of the virus that causes Covid-19.

The question remains: Will the strategies of China, Europe and the US succeed in managing Covid-19 in 2023?

9) Supply Chain Vulnerabilities Continue to Drive Digital Transformation Forward

The rapid spread of COVID-19 in early 2020 revealed vulnerabilities in the value chains of virtually every industry. Many resulted in shutting down production lines and canceling orders. The pandemic revealed just how delicate the interdependencies of multi-tier supplier relationships had become. It was a wake-up call for business leaders to shift away from time-consuming supply chain practices such as live meetings to more agile ways of managing risk.

From the very early days of the pandemic, COVID-19 forced companies to require employees to work at home. While disruptive, the decision revealed the immediate need to shift sales and service interactions from live meetings and teleconferences to digital channels. Suppliers and distributors had no choice but to accept the limited direct access to their customers and embrace the new digital rules to remain vital to their customers.

The shift created challenges in the product design and development cycle. The engineering teams needed information about component quality, availability, cost, and lifecycle data typically unavailable to those responsible for creating technical content. Out of necessity, design engineers began searching for design insights and related technical content across digital channels, peer community sites, vertical search engines and media sites instead of the websites of component manufacturers and distributors.

It is still early in the shift to digital channels, as today’s cross-functional collaboration is cumbersome at best. The reason is that work efforts are managed across disparate enterprise systems that don’t engage with each other. These systems include electronic design automation (EDA), product lifecycle management (PLM), strategic sourcing, supply chain management (SCM), enterprise resource planning (ERP), analytics, procurement, and other applications.

With the handicap of managing limited information, different departments tend to make decisions in isolation, based on their knowledge of a particular part in the process, rather than applying a more holistic view. This narrow view has deleterious business and financial impacts, such as delays in bringing products to market, lost opportunities for cost savings, and a weakened and fragile supply chain.

It is not an unsolvable problem. The first step is to embrace digital channels.

10) US Ban on Selling Advanced Technology to China Reshapes the Chip Market

The US Department of Commerce’s October 2022 decision to ban the transfer of advanced US semiconductor technology to Chinese companies was a significant blow for both sides. The ban affects not only US firms that sell to China but companies from other nations that use American semiconductors in their equipment sold in China.

Chinese companies that rely on the banned US chips are assessing the viability of their businesses. In the US, semiconductor companies and other tech firms that count China among their largest single markets are facing a potentially severe decline in revenue. Non-US companies that manufacture tech products in China were required to recall US employees because the ban also bars “US persons” from supporting technology covered by the ban.

Officials from the Ministry of Industry and Information Technology summoned executives from domestic semiconductor manufacturers to assess how being deprived of high-tech manufacturing tools from overseas would impact their businesses. And companies that rely on imports of high-end semiconductors are assessing their viability.

Large semiconductor manufacturers such as Taiwan Semiconductor Manufacturing Company (TSMC), South Korea’s Samsung, and Netherlands-based ASML, which makes chip manufacturing equipment, are exploring the financial impact of the ban on their bottom lines.

TSMC, the world’s largest chip foundry, is expected to take advantage of US financial incentives from the CHIPS Act to expand its manufacturing footprint in Arizona. TSMC’s plan is to build the second US plant next to its $12 billion complex that is already under construction. TSMC’s decision is expected to bolster American efforts to bring advanced chipmaking back onshore if it goes ahead.

Here Comes 2023

With 2022 coming to a close, we turn our attention to the new year, and the opportunities that come with it. Many of the entries from this list will certainly influence our industry in the next twelve months, some perhaps drastically.

Supplyframe partners with countless industry leaders to accelerate their digital transformation and take control of their supply chain. To set your business up for success in the new year, learn more about our Design-to-Source Intelligence Solutions today!