- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

As the end of the year approaches, the electronics market is nearing a finish line of its own, with the supply chain largely resolving the lead time and pricing issues that have plagued buyers throughout most of the year.

Moreover, the customary peak-season rise in component demand growth in the second half is shaping up to be weaker than expected in 2023, affording further improvements in purchasing conditions. Finally, global GDP growth has decelerated significantly compared to 2022, although the world’s top economies, except China, display some resilience in Q4.

Conditions for Buyers are ‘Just Right’ Heading into 2024

For buyers, the electronics supply chain has entered the Goldilocks Zone, where the climate is neither too hot nor too cold but mostly habitable. However, moderation (and, in some instances, resolution) of supply chain issues in 2023 will lead to new challenges in 2024, as asymmetrical demand elasticities and related supply constraints stimulate rising prices and extended lead times.

Retreating demand and lead times prove that conditions have reached a more comfortable state for the buy side of the supply chain. The Commodity IQ Lead Time Index for all electronic components fell below the baseline in September and October for the first time since February 2021 – indicating that overall lead times are indeed contracting, following 29 consecutive months of expansion. Just 10% of all components will experience lead time increases in Q4, while 27% will see decreases and 63% will be stable.

Lead time compression materialized as the severe excess inventory situation in the electronics supply chain continued to improve. The Commodity IQ Inventory Index for all electronic components has lingered below the pre-pandemic baseline for multiple quarters, indicating a sustained decrease in component lead times.

An initiative among the top memory suppliers to slash production in 2023 has affected the inventory decline. Despite board-based inventory contractions across 42% of all major component commodities, sourcing difficulties persist for certain parts, particularly those with downsized production capacities, like DRAM, NAND, and specific passive devices.

Commodity pricing through Q4 2023 favors the buy-side, with nearly three-quarters of component commodity price dimensions either declining (48%) or stabilizing. However, pricing trends are mixed, with costs increasing in October for categories including standard logic and memory – but falling for major product segments like MCUs and MPUs, capacitors, and resistors. The forecast for H1 2024 electronic components shows just 4% of price dimensions on the rise and 72% in stable mode, as component manufacturers mostly prefer capacity utilization modulation over price reductions in this environment.

Memory: A Commodity to Watch in 2024

The pricing dimensions for materials (including metals and batteries) and operations (including logistics and labor) will follow a similar pattern through Q4. Stable pricing for 80% of material dimensions and 58% for operations are projected.

From a component perspective, the price and availability outlier for Q4 2023 is memory – specifically, NAND flash- in addition to DDR4, DDR5, and HBM (high-bandwidth memory) DRAM. DDR4 price flexibility is still available for hard orders, yet it will not last beyond Q2 2024. With DDR5 ready to dominate the market (with more than 25% PC penetration currently), both technologies will begin to see supply constraints in 2024, lasting into 2025.

Memory content for Smartphones, automobiles, and both storage and AI data center applications is continuously increasing, with AI-related memory set for explosive growth into 2025. NAND flash, standard and mobile DDR DRAM, and HBM DRAM will be problematic for procurement organizations.

Automotive Demand Decelerates

Demand trends also conform to the Goldilocks scenario, with sales increases in some areas like PCs and smartphones counterbalanced by declines or slowing growth in other applications like servers and automotive, preventing the electronic component market from overheating.

Market watchers expect PC sales in Q4 to rebound from recent declines, with some forecasts pegging year-over-year growth in the low double-digits. Smartphone shipments are rising in Q4 as well, as demand increases from record-low levels, although the increase is likely to be tepid at best, and questions of sustained demand remain.

Server shipments will decline in the mid-single-digit range in 2023, with a sequential decline expected in Q4. Moreover, signs have appeared that demand from the formerly red-hot automotive sector is beginning to cool. Automotive chip suppliers have indicated they are downwardly adjusting their capacity utilization to adjust to the slowdown. EV sales growth is falling short of industry expectations in late 2023, mitigating demand increases for the entire automotive market.

Nevertheless, any abrupt and concentrated end-market demand increases will yield component availability issues. Some supply chain players are forecasting four-fold increases in AI-related business in H1 2024. HBM leader SK Hynix, in its fiscal Q3 2023 earnings call in late October, hinted that its capacity for HBM products is fully committed into 2025. The aerospace & defense segment is also viewed as very strong into H1 2024.

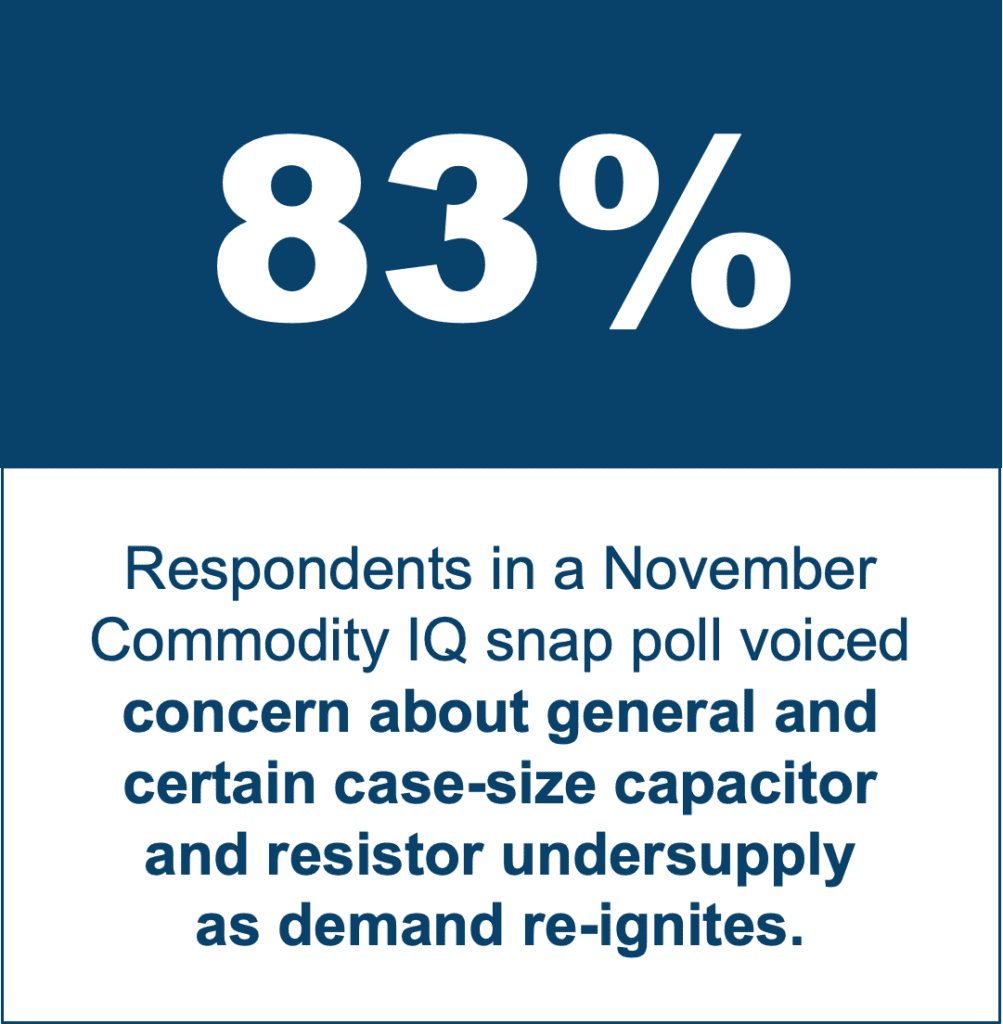

These factors, combined with low production rates, initial recovery seen in smartphones, and the upward trend in the Commodity IQ Design Index, may lead to supply constraints beyond memory ICs in 2024.

Sourcing Benefits Endure with Economic Conditions

Although signs of macroeconomic resilience have appeared this year and inflation rates have fallen, production and consumption generally remain below pre-pandemic levels. Global GDP is forecast to rise by 3.4% in 2023. However, the United States is the only example of a strong recovery among advanced economies.

At the same time, the eurozone will continue to suffer from a slower-than-anticipated resurgence, according to the IMF. In short, the global economy needs to grow more quickly to cause significant increases in demand or pricing.

With U.S. inflation cooling and unemployment lingering near record-low levels, the country’s GDP is rising, beating economists’ expectations. The combination of solid growth and moderating price increases indicates that the economy continues to expand without spurring renewed inflationary pressures.

After disappointing economic revelations from China, the country’s 2023 growth outlook has diminished sharply. Yet, recent initiatives by the Chinese government to aid the country’s troubled property market have prompted the IMF to raise the country’s 2023 GDP outlook to 5.4%, up from 4.2% – representing a sharp increase from 3% growth in 2022 when China enacted stringent COVID-19 policies. China’s economic growth, stifled mainly by the property sector crisis, is well below historical averages, indicating its moderately paced economic advancement won’t trigger a sharp price increase.

Economic realities, lagging demand in key end markets, and inhibited inventory digestion combine to extend the buyer’s market for electronic components and adjacent commodities in the first half of 2024.

To stay up-to-date on the latest electronics commodity news, subscribe to IQ Insider today!