- Solutions

ENTERPRISE SOLUTIONS

Infuse new product development with real-time intelligenceEnable the continuous optimization of direct materials sourcingOptimize quote responses to increase margins.DIGITAL CUSTOMER ENGAGEMENT

Drive your procurement strategy with predictive commodity forecasts.Gain visibility into design and sourcing activity on a global scale.Reach a worldwide network of electronics industry professionals.SOLUTIONS FOR

Smarter decisions start with a better BOMRethink your approach to strategic sourcingExecute powerful strategies faster than ever - Industries

Compare your last six months of component costs to market and contracted pricing.

- Platform

- Why Supplyframe

- Resources

Welcome back from what was hopefully a happy and restful holiday season. A new year always brings with it resolutions, and from where we are sitting, it looks like American Industry and Government at large has resolved to invest heavily–quite heavily–in domestic semiconductor manufacturing.

- Ford announced a deal with semiconductor manufacturer GlobalFoundries to increase their chip supply to the Dearborn, Michigan based automaker.

That’s a lot of money, and it just begins to properly highlight the huge role these tiny chips play in the world today. They’re in our phones, our cars, medical equipment, electric toothbrushes and intercontinental ballistic missiles. Our daily life, and some would say national defense, depends heavily on these slim silicon wafers.

COVID Started It, but The Storm Was Already Brewing

It’s a familiar story at this point. Around March 2020 a globally interconnected industry got rocked by labor, raw material, and transportation shortages. Prices skyrocketed and there weren’t enough goods to go around. Floods and fires made it worse. Lots of people lost money.

Companies that rely on high-tech chips got hit particularly hard. The auto industry missed out on $200bn in sales. The cost of a chip necessary for ultrasound machines went from $1.49 to $65 in short order.

The obvious solution is to build more chip fab and increase overall global supply, right? Well…yes, no, and maybe.

Analysts say building a fab of any size takes at a minimum $10bn and two years. Most of the projects we listed above are at least that far from sending chips out the door. By the time you’re done, Moore’s Law means the chips you’re making could be obsolete. And once you’re there, staying on top is almost impossible. Of the top ten chipmakers by revenue in 1990, only two (Intel and Texas Instruments) are still in the top ten in 2021.

But chips sometimes get conscripted into less consumer friendly duty. They are essential for the weapons of modern defense, and their production is considered of strategic interest to the United States of America. Most of this production takes place in Taiwan. Congress and The Pentagon want to see domestic chip production and know they could help get the ball rolling with a big infusion of cash.

Enter The CHIPS Act

“It is the sense of Congress that the leadership of the United States in semiconductor technology and innovation is critical to the economic growth and national security of the United States.”

Senate Bill S. 3933 (The CHIPS Act)

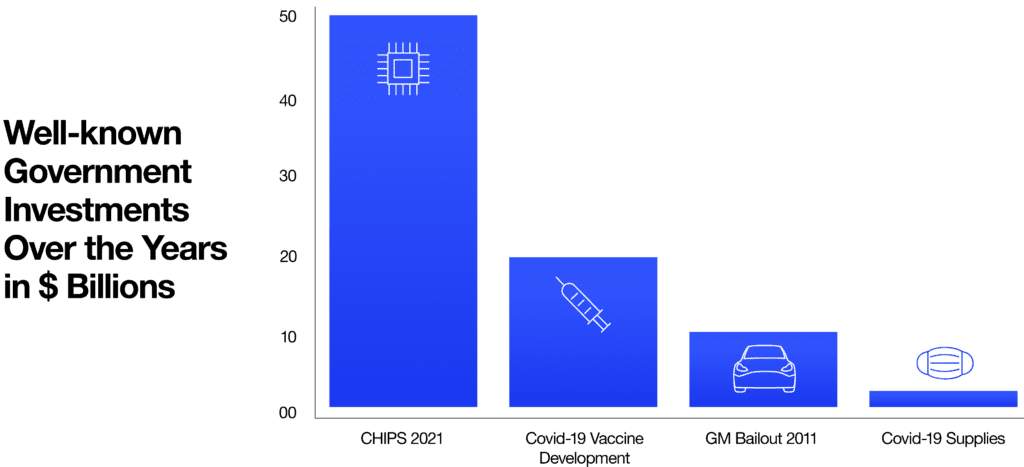

And that’s what brought us the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act. It’s a huge $50 bn investment in domestic manufacturing that earned Congressional approval in early December as part of the National Defense Authorization Act of 2022. CHIPS is as controversial as it is expensive. And it’s very, very expensive.

It’s very simply one of the biggest investments in American industrial policy in the history of the country. And we’ve gone down this road with semiconductors before. In 1987, in the face of increasing competition from Japan, Congress created SEMATECH, a $500 million industry consortium and investment in…domestic semiconductor manufacturing. The New York Times called it “an experiment without precedent in [American] industrial policy.”

The takeaway? Nobody knows if it worked.

Academics analysts have pored over SEMATECH data for years but studies remain inconclusive. If CHIPS money is well spent, and the investment continues, it could be a down payment toward a more stable and secure future.

China has pledged a staggering $180 billion dollars towards its domestic chip manufacturing capability since 2015, and aims for self-sufficiency in electronics production by the 2050s. But money does not an industry make, and many analysts regard China’s attempts to beef up their chip production as a flop.

CHIPS has a chance. The White House is behind it, we don’t live in the geopolitical world of the 1980s, and one would hope that firms getting grants and tax credits for R&D spending will be good stewards of that capital. Some people think they won’t, but it’s a new year so let’s take a positive outlook. Three cheers for CHIPS.

2022 and Beyond: What Does The Future Hold?

All of this can seem pretty far removed from your day-to-day life if you’re not in the semiconductor business. Even if you are, it could be years before there’s an appreciable effect on what you do. But programs like CHIPS always have ripple effects, and it’s good to be prepared for “good” disruption within the industry.

But we think there are more lessons for leaders within the electronics supply chain. Not too many of us would have predicted this resurgence in domestic chipmaking a few years ago, yet here we are.

CHIPS will need collaborative alliances between firms to work. Do you have a vital supplier whose needs align with yours? Talk to them. Develop the relationship. Work together to stabilize your supply, price, and schedules.

In a way, CHIPS should inspire us to try things we didn’t think were possible. Reclaiming superiority in the silicon space is a bit of a moon shot, but we’re going for it. So go for it. Find your firm’s moonshot and make a plan to get there. It might not happen, but you’ll probably discover some interesting things on the journey.

One thing that will certainly help during the next few years is visibility and market intelligence. Once new foundries come online, and the lines start making chips, there’ll probably be a rush to secure early supplies.

We can help you with previously unseen visibility and intelligence into the global electronics value chain with our Commodity IQ solution. It’s an always-on approach to market intelligence, powered by AI, that’ll give you the visibility and flexibility you need. For more information, check out Commodity IQ.